Tesla Starlink integration patent china — "Satellite" Inside the Cabin

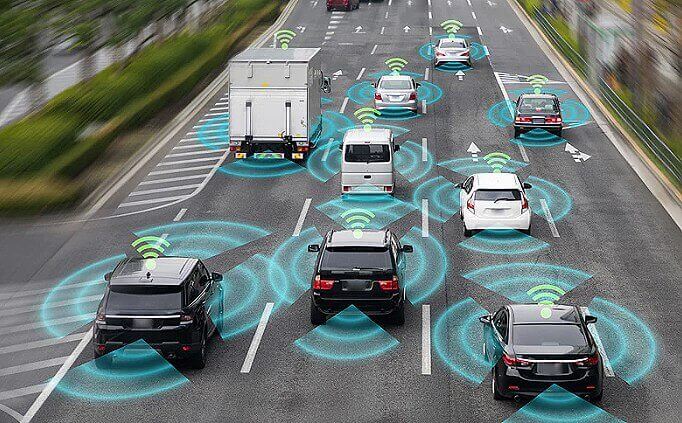

The automotive world is witnessing a quiet revolution. While everyone obsesses over battery ranges and autonomous driving, a different race is heating up: Tesla Starlink integration patent china represents the next frontier of connectivity. We’re talking about satellite internet inside your car—no cell towers required.

Why does this matter? Because GSM and LTE networks are showing their age. Drive through rural America, climb mountain roads in Tibet, or cruise Australia’s Outback, and your smartphone becomes a useless brick. Tesla’s recent patent filings hint at a future where your car stays connected anywhere on Earth. Meanwhile, Chinese automakers aren’t sitting idle—they’re embedding satellite antennas directly into vehicle architecture.

This isn’t science fiction. It’s happening now, and Tesla Starlink integration patent china is the keyword unlocking this transformation. Let’s break down what’s really going on under the hood.

1. Tesla Starlink integration patent china and in-car satellite internet

Tesla Starlink integration patent china isn’t just corporate paperwork—it’s a roadmap. According to filings analyzed by Electrek and patent databases, Tesla is exploring methods to integrate Starlink terminals directly into vehicle structures. The goal? Seamless satellite connectivity without those bulky external dishes you see on RVs.

In-car satellite internet solves a fundamental problem: cellular dead zones. Traditional LTE relies on ground-based towers with limited range. Drive 50 kilometers outside any major city, and you’re often left with zero bars. SpaceX’s Starlink constellation—over 5,000 low-Earth orbit (LEO) satellites as of late 2024—changes the equation entirely.

Tesla’s approach focuses on “invisible” integration. Instead of mounting obvious antennas on the roof, patent documents describe embedding phased-array antennas within existing body panels or glass structures. The Tesla Starlink integration patent china connection becomes clear when you consider Tesla’s Gigafactory in Shanghai: Chinese regulatory approval would be essential for any satellite-equipped vehicles sold domestically.

Here’s what makes in-car satellite internet compelling for automakers:

Continuous coverage: No more “searching for signal” notifications. LEO satellites provide coverage across oceans, deserts, and polar regions—anywhere your car can physically drive.

Emergency reliability: When natural disasters knock out cell towers, satellite links remain operational. This matters for emergency services, fleet management, and personal safety.

Data-hungry features: Modern vehicles stream music, navigation updates, over-the-air software patches, and real-time telemetry. Satellite bandwidth can handle these demands without congesting local cell networks.

Tesla isn’t alone in this vision, but their Tesla Starlink integration patent china approach leverages vertical integration—they own the satellite network (via SpaceX) and the vehicle platform. Chinese competitors must partner with domestic satellite operators like GalaxySpace or international providers, creating different technical and regulatory challenges.

If satellite tech is making cars smarter off-grid, the next upgrade is making your business smarter in real time. Meetings still waste hours—and that’s where AI assistants win. Fireflies records calls, summarizes key points, and pushes notes into your CRM so nothing gets lost after Zoom ends. See how it works: https://aiinnovationhub.shop/fireflies-ai-meeting-assistant-zoom-meet-crm/

2. satellite communication in cars — Comparison Table

Understanding satellite communication in cars requires comparing approaches. Here’s how major players stack up:

| Approach | Technology | Primary Use Case | Coverage Region | Expected Launch |

|---|---|---|---|---|

| Tesla/Starlink | LEO phased-array antenna, embedded in vehicle structure | Full internet connectivity, streaming, navigation, OTA updates | Global (pending regulatory approval) | 2025-2026 (patent phase) |

| Geely/Geespace | Glass-integrated antenna in panoramic sunroof | Emergency messaging, basic connectivity, fleet telemetry | China domestic, expanding to Belt & Road regions | 2024-2025 (production models announced) |

| Traditional Auto + Iridium/Globalstar | External antenna module, aftermarket or dealer-installed | Emergency SOS, low-bandwidth messaging | Global (mature satellite networks) | Available now (limited adoption) |

| Smartphone-tethered (Huawei, Apple) | Phone’s built-in satellite radio, car acts as interface | Emergency messaging, text-based communication | Regional (China, North America) | 2023-2024 (already shipping) |

The satellite communication in cars landscape shows clear divergence. Tesla’s Tesla Starlink integration patent china aims for full-bandwidth internet—think Netflix streaming and video calls. Chinese manufacturers like Geely focus on pragmatic emergency features first, gradually scaling up capability. Traditional automakers hedge bets with aftermarket solutions while evaluating consumer demand.

Notice the regulatory dimension: Tesla Starlink integration patent china signals Tesla’s intent to navigate Chinese approval processes. China maintains strict controls over satellite communications and mapping data. Any foreign satellite service must comply with cybersecurity reviews and data localization requirements. Tesla’s patent filings in China suggest they’re willing to work within these frameworks, possibly through partnerships with local operators or hybrid network architectures.

3. RF-transparent roof antenna — Why Antennas Hide Inside Structure

The technical magic behind Tesla Starlink integration patent china lies in RF-transparent roof antenna design. “RF-transparent” means radio-frequency signals pass through materials without significant loss. This allows engineers to hide antennas beneath body panels, windshields, or panoramic roofs.

Why bother hiding antennas? Three reasons: aerodynamics, aesthetics, and durability.

External antennas create drag, reducing range and efficiency. Every protruding element disrupts airflow. For EVs obsessed with maximizing every kilometer per charge, a sleek RF-transparent roof antenna beats a traditional shark-fin or dome antenna.

Aesthetics matter more than engineers admit. Car buyers want clean lines, not equipment that screams “I bolted aftermarket tech onto my vehicle.” Integrating satellite capability invisibly preserves design language. Tesla’s minimalist design philosophy—no visible door handles, hidden sensors—extends naturally to connectivity hardware.

Durability concerns are practical: external antennas face vandalism, car wash damage, and harsh weather. Embedding antennas inside RF-transparent materials protects electronics while maintaining signal quality. According to technical analysis by Teslarati, Tesla’s patents describe using specially formulated glass or polymer composites for roof panels, optimized for frequencies used by Starlink (10.7–12.7 GHz downlink, 14.0–14.5 GHz uplink).

The RF-transparent roof antenna approach requires precise engineering. Glass isn’t naturally transparent to all radio frequencies—metallic coatings for UV protection or heating elements can block signals. Tesla’s patent documents outline methods to pattern these coatings, creating “windows” for RF transmission while maintaining thermal and optical properties. Chinese competitors like Geespace (Geely’s satellite subsidiary) pursue similar strategies, leveraging their experience manufacturing panoramic sunroofs.

Challenges remain: RF-transparent roof antenna systems must handle antenna gain (signal strength), beam steering (tracking satellites as they move across the sky), and interference mitigation (avoiding conflicts with GPS, 5G, and other onboard radios). Phased-array antennas—multiple small elements working together—solve these problems by electronically steering beams without moving parts. This is the same technology Starlink home terminals use, now miniaturized for automotive applications where Tesla Starlink integration patent china leads development efforts.

Satellite connectivity keeps you online when cell networks vanish—but what about making conversations feel human when the signal is perfect? That’s where empathic voice AI enters the chat. Hume AI’s EVI listens for emotion, adapts tone, and builds more natural interactions for support, sales, and assistants. Full overview: https://aiinovationhub.com/aiinnovation-hume-ai-empathic-voice-interface/

4. LEO satellite connectivity for vehicles — Speed, Latency, Coverage

LEO satellite connectivity for vehicles promises a connectivity paradigm shift. LEO (Low Earth Orbit) satellites circle the planet at 500–1,200 kilometers altitude, dramatically closer than traditional geostationary satellites parked 35,000 kilometers up.

Proximity matters because physics is unforgiving. Radio signals travel at light speed—fast, but not instantaneous across tens of thousands of kilometers. Geostationary satellite internet suffers ~600 millisecond latency—the time between requesting data and receiving it. LEO satellite connectivity for vehicles cuts that to 20–40 milliseconds, comparable to good 4G LTE.

Why does latency matter for cars? Real-time applications. Video calls become tolerable. Cloud gaming works. But more critically: LEO satellite connectivity for vehicles enables time-sensitive safety features. Vehicle-to-vehicle (V2V) communication, remote diagnostics, and emergency response systems require sub-100ms response times. With geostationary satellites, you’d issue a command and wait—potentially dangerous in crisis situations.

Speed (bandwidth) is equally transformed. Early satellite internet maxed out at dial-up speeds. LEO satellite connectivity for vehicles through Starlink delivers 50–200 Mbps downstream, sufficient for streaming, large software updates, and supporting multiple devices simultaneously. Tesla’s Tesla Starlink integration patent china documents suggest targeting 100+ Mbps sustained throughput, assuming unobstructed sky view.

Coverage is where LEO satellite connectivity for vehicles truly shines. Starlink’s constellation provides service across all continents, oceans, and polar regions (above certain latitudes). No cellular network matches this geographic reach. For logistics companies operating trans-continental routes, mining operations in remote areas, or adventure travelers, LEO satellite connectivity for vehicles eliminates connectivity blackout zones.

Energy budget presents the main engineering challenge. Satellite terminals consume power—typically 50–75 watts for consumer Starlink dishes. For gasoline vehicles, this is negligible. For EVs obsessed with range, it’s significant. Tesla’s Tesla Starlink integration patent china filings address power management: intelligently sleeping the terminal when parked, optimizing beam patterns to reduce transmission power, and potentially using vehicle motion sensors to predict satellite handoffs (reducing search time and power spikes).

Chinese manufacturers approaching LEO satellite connectivity for vehicles face additional constraints. Domestic operators like GalaxySpace and China SatNet are still building their constellations. As of early 2025, coverage remains limited compared to Starlink’s mature network. This explains why Tesla Starlink integration patent china focuses initially on emergency messaging and basic connectivity, scaling up as infrastructure matures.

5. satellite emergency messaging vehicle — Scenarios Where It’s Must-Have

Satellite emergency messaging vehicle capability isn’t a luxury—it’s a lifeline. Consider these scenarios where cellular networks fail:

Off-road adventures: Overlanding enthusiasts frequently venture beyond cell coverage. A breakdown 200 kilometers into the Australian Outback without satellite emergency messaging vehicle systems means hiking for days or hoping another vehicle passes. With satellite capability, you summon help directly.

Mountain regions: Valleys and canyons block cellular signals. Ski resorts, mountain passes, and hiking trail access roads create connectivity dead zones. Satellite emergency messaging vehicle ensures hikers, climbers, and winter sports enthusiasts maintain emergency contact. China’s growing ski industry and alpine tourism make this feature increasingly relevant for domestic automakers.

Highway stretches: Major routes crossing Siberia, the Australian interior, western North America, or western China go hundreds of kilometers between cell towers. Accidents, medical emergencies, or mechanical failures in these zones become dangerous without satellite emergency messaging vehicle backup.

Disaster response: Earthquakes, floods, hurricanes, and wildfires destroy cellular infrastructure. First responders, utility crews, and evacuees need reliable communication. Satellite emergency messaging vehicle systems remain operational when ground networks collapse. This became evident during recent natural disasters where satellite phones proved essential.

Fleet logistics: Long-haul trucking, mining operations, and agricultural fleets operate in remote areas. Satellite emergency messaging vehicle enables real-time tracking, performance monitoring, and two-way communication regardless of location. This improves safety, reduces downtime, and optimizes routes.

The Tesla Starlink integration patent china approach aims beyond basic SOS buttons. While competitors offer text-message-only emergency services, Tesla’s patent documents describe rich data transmission: vehicle diagnostics, location coordinates, even cabin camera feeds for security purposes. This positions satellite emergency messaging vehicle as a premium safety feature rather than bare-minimum compliance.

Chinese regulators increasingly mandate emergency communication systems. Ministry of Industry and Information Technology (MIIT) guidelines encourage automakers to implement satellite emergency messaging vehicle capability, especially for vehicles marketed for long-distance travel. This regulatory push explains why Geely, NIO, and other domestic brands prioritize satellite partnerships—it’s both a competitive feature and potential compliance requirement.

6. Huawei Mate 70 satellite messaging as Market Expectation Trigger

The Huawei Mate 70 satellite messaging launch accelerated consumer awareness dramatically. When Huawei unveiled the Mate 70 series in late 2024, it wasn’t just another flagship phone—it was China’s second-generation satellite-connected smartphone.

Huawei Mate 70 satellite messaging offers two-way text communication via China’s Tiantong satellites. Unlike earlier models limited to sending messages, the Mate 70 receives replies, creating actual conversation capability. According to Global Times reporting, Huawei partnered with China Telecom to provide coverage across all of China plus surrounding waters—critical for maritime use and remote regions.

Why does Huawei Mate 70 satellite messaging matter for automotive? It shifts expectations. Consumers who experience satellite connectivity on their phones naturally ask: “Why doesn’t my car have this?” The technology becomes normalized, not exotic. When someone successfully texts family during a remote hiking trip using Huawei Mate 70 satellite messaging, they understand the value proposition—and expect similar capability in their vehicle.

This psychological shift accelerates Tesla Starlink integration patent china and competing efforts. Automakers can no longer dismiss satellite connectivity as niche or experimental. It’s becoming a expected premium feature, like wireless phone charging or advanced driver assistance. The Huawei Mate 70 satellite messaging proves consumer hardware can integrate satellite radios without prohibitive cost or bulk.

Chinese social media discussions following the Huawei Mate 70 satellite messaging launch explicitly mentioned automotive applications. Weibo and Zhihu users debated which EV brands would be first to offer similar capability. NIO, XPeng, and Li Auto faced questions about their satellite roadmaps. This grassroots pressure influences product planning—companies accelerate features when consumers actively demand them.

The Huawei Mate 70 satellite messaging also demonstrates regulatory pathways work. China’s strict satellite communication controls didn’t block the phone’s approval, suggesting authorities support expanding civilian satellite services. This regulatory clarity helps automotive manufacturers like those pursuing Tesla Starlink integration patent china integration navigate approval processes with confidence.

Interestingly, the Huawei Mate 70 satellite messaging approach differs from Apple’s Emergency SOS via satellite (using Globalstar). Huawei’s Tiantong system uses higher orbits (geostationary) with larger antennas and more power consumption, but provides wider coverage per satellite. This design choice reflects China’s satellite infrastructure priorities—fewer, more powerful satellites rather than massive LEO constellations. Understanding these technical philosophies helps interpret why Tesla Starlink integration patent china might pursue hybrid approaches, combining LEO and geostationary capabilities depending on regional regulatory requirements.

7. Chinese EV satellite connectivity — Ecosystem and Smart Cockpit Integration

Chinese EV satellite connectivity represents more than hardware—it’s about ecosystem integration. Chinese automakers don’t just build cars; they build mobile digital ecosystems rivaling smartphones.

The “smart cockpit” philosophy dominates Chinese EV design. Vehicles feature multiple screens, voice assistants, app stores, and seamless smartphone integration. Chinese EV satellite connectivity becomes the ultimate connectivity layer, ensuring these digital ecosystems function everywhere.

Geely leads with tangible plans. Their Geespace satellite subsidiary, established in partnership with China SatNet, aims to launch 240 LEO satellites by 2026. According to KrASIA reporting, Geespace’s glass antenna technology integrates directly into panoramic sunroofs on upcoming Geely, Volvo, and Polestar models. This Chinese EV satellite connectivity approach keeps costs reasonable by using existing vehicle components.

NIO takes a different path. Their battery-swap stations—over 2,000 installed across China—could double as ground stations for satellite networks. Each station already has power, internet connectivity, and physical infrastructure. Adding satellite ground equipment creates a hybrid network: vehicles use cellular/WiFi near swap stations, switching to satellite in remote areas. This is Chinese EV satellite connectivity leveraging existing infrastructure investments.

XPeng explores partnerships with domestic satellite operators. Their upcoming G9 SUV reportedly includes hardware provisions for satellite antennas, with activation via over-the-air updates once regulatory approvals complete. This modular approach—install hardware now, enable features later—mirrors how Tesla Starlink integration patent china might roll out: shipping antenna-ready vehicles, activating service market-by-market as approvals clear.

Chinese EV satellite connectivity faces unique regulatory considerations. Data sovereignty matters intensely. Chinese authorities require that satellite data passing over China be accessible to regulators. Foreign satellite operators like Starlink must either partner with Chinese entities or maintain separate infrastructure complying with local data laws. This explains why Tesla Starlink integration patent china patent filings emphasize adaptability—the system must accommodate different regulatory frameworks.

The competitive dynamics are fascinating. Chinese EV satellite connectivity efforts intentionally position domestic manufacturers as technology leaders rather than followers. By deploying satellite systems simultaneously with (or before) Tesla, Chinese brands shed the “catching up” narrative. They become pioneers in connectivity—a powerful marketing message for premium EV buyers.

8. Starlink automotive integration patent — Patents as Product Roadmap

Reading Starlink automotive integration patent documents requires understanding what patents reveal—and conceal. Companies file patents to protect innovations, but also to signal strategic direction without committing to specific timelines.

Tesla’s Starlink automotive integration patent portfolio (searchable via USPTO and WIPO databases) describes several key innovations. One patent outlines methods for integrating phased-array antennas into vehicle roofs without compromising structural integrity or waterproofing. Another addresses beam-steering algorithms optimized for vehicles in motion—tracking satellites while the car accelerates, turns, or travels through tunnels.

According to Electrek analysis, a particularly interesting Starlink automotive integration patent describes dual-mode antennas: one array optimized for stationary use (parked vehicle, maximum bandwidth), another for driving (reduced bandwidth, better handoff reliability). This suggests Tesla recognizes that delivering full Starlink performance while moving presents challenges—so they’re designing systems that gracefully degrade, maintaining connectivity rather than dropping completely during difficult conditions.

The Starlink automotive integration patent filings also hint at business model considerations. One patent describes systems for metering bandwidth consumption and dynamically adjusting quality-of-service based on subscription tiers. This implies Tesla envisions multiple service levels: basic emergency messaging included free, full internet as a subscription add-on. This tiered approach mirrors how Tesla currently sells Premium Connectivity as a monthly subscription.

Geographic patent filings reveal strategy too. Tesla Starlink integration patent china appears in both USPTO and China National Intellectual Property Administration (CNIPA) databases. This parallel filing indicates serious intent—companies don’t pay patent filing fees in jurisdictions they don’t plan to operate in. The Chinese patent filings specifically address concerns about data localization and integration with domestic satellite operators, suggesting Tesla prepared for partnership or licensing scenarios.

Patent language provides clues about timelines. Recent Starlink automotive integration patent applications reference “production-ready” manufacturing processes and “cost-optimized” components. This language shift from earlier, more theoretical patents suggests technology moving from research phase toward implementation. However, patents alone don’t guarantee products—automotive development requires years of testing, certification, and regulatory approval.

Competitors study these patents carefully. Starlink automotive integration patent documents essentially provide free technical education to rivals. Chinese manufacturers can examine Tesla’s approaches, identify alternative solutions avoiding patented methods, or potentially license the technology. This explains why some Tesla Starlink integration patent china filings remain deliberately vague on certain implementation details—protecting core intellectual property while fulfilling patent disclosure requirements.

9. Geespace glass antenna sunroof — Final Verdict and 2026 Outlook

Geespace glass antenna sunroof represents the most tangible near-term satellite vehicle implementation. Unlike Tesla’s patent-stage concepts, Geespace (Geely’s satellite subsidiary) demonstrated working prototypes in late 2024 and announced production integration for 2025 model-year vehicles.

The Geespace glass antenna sunroof approach embeds antenna elements directly into panoramic glass roofs—already standard on many premium EVs. According to KrASIA reporting, this integration adds minimal cost (estimated $300-500 per vehicle at scale) while providing basic satellite connectivity. Initial capability focuses on emergency messaging and low-bandwidth telemetry, with plans to scale up as Geespace’s satellite constellation expands.

This pragmatic strategy contrasts with Tesla Starlink integration patent china ambitions. Geespace prioritizes shipping something now rather than waiting for full-bandwidth capability. Chinese consumers get satellite emergency messaging in 2025, establishing Geely as the first major automaker deploying integrated satellite connectivity at volume.

The Geespace glass antenna sunroof hardware includes provisions for future upgrades. As Geespace launches more satellites (240 planned by 2026), over-the-air software updates can unlock additional bandwidth and features. This modular approach reduces early adoption risk—buyers get immediate safety benefits, with performance improvements rolling out as infrastructure matures.

So, who wins the “connectivity without GSM” battle?

Short term (2025-2026): Chinese manufacturers like Geely/Geespace lead in deployment, offering basic satellite capability on production vehicles. The Geespace glass antenna sunroof ships first, establishing market presence and brand association with advanced connectivity.

Medium term (2026-2027): Tesla Starlink integration patent china could leapfrog competitors if regulatory approvals clear. Starlink’s mature satellite network provides immediate global coverage and superior bandwidth. However, Tesla must navigate Chinese data sovereignty requirements—potentially limiting full capabilities or requiring partnerships.

Long term (2028+): Multiple solutions coexist. Premium vehicles might integrate multiple satellite systems (domestic Chinese networks and international providers like Starlink), similar to how phones support multiple cellular bands. Software would seamlessly switch between networks based on location and regulatory frameworks.

What readers should watch for on www.autochina.blog:

Regulatory announcements: China’s Ministry of Industry and Information Technology (MIIT) holds keys to Tesla Starlink integration patent china and foreign satellite approvals. Any policy changes regarding satellite communications licensing will rapidly impact deployment timelines.

Geespace constellation launches: Track Geespace’s satellite deployment progress. Each launch expands coverage and capability for vehicles with Geespace glass antenna sunroof hardware already on roads.

Tesla’s Chinese partnerships: Watch for announcements about Tesla partnering with Chinese satellite operators or data centers. Such partnerships would signal serious Tesla Starlink integration patent china implementation rather than speculative patents.

Competitor responses: NIO, XPeng, Li Auto, and BYD will announce their satellite strategies throughout 2025-2026. These announcements reveal whether satellite connectivity becomes standard premium EV equipment or remains niche.

Consumer adoption metrics: Most critical—do buyers actually use and value satellite connectivity? Early Geespace deployments will generate real-world usage data, showing whether consumers see this as must-have or irrelevant. This data determines whether Tesla Starlink integration patent china becomes priority investment or deprioritized feature.

Conclusion

The Tesla Starlink integration patent china story is really about the future of vehicle connectivity. We’re transitioning from “occasionally disconnected” to “always connected”—regardless of location. Satellite technology makes this possible, and automakers race to implement it before consumers demand it.

Tesla’s patent strategy signals serious intent. Chinese manufacturers aren’t waiting—they’re deploying systems now. The Geespace glass antenna sunroof, Huawei Mate 70 satellite messaging, and broader Chinese EV satellite connectivity efforts demonstrate that China views satellite infrastructure as strategic necessity, not luxury.

For automotive enthusiasts and industry watchers, satellite emergency messaging vehicle and LEO satellite connectivity for vehicles represent the next major feature differentiation. Just as fast charging networks became crucial EV infrastructure, satellite networks will define next-generation vehicle capability.

Stay updated on these developments at **www.autochina.blog continue tracking Tesla Starlink integration patent china progress, Chinese manufacturer deployments, and the evolving regulatory landscape that determines when and how these technologies reach your driveway.

The race is on. The prize? Never being disconnected again, no matter where your vehicle takes you.

Discover more from AutoChina

Subscribe to get the latest posts sent to your email.